Home equity lenders for poor credit

Many borrowers can get a home equity loan or HELOC even with bad credit. Our top-ranked provider of subprime home equity loans is eMortgage.

Percent Of Owner Occupied Housing With A 2nd Mortgage Home Equity Loan By U S County Vivid Maps Mortgage Payoff Home Equity Home Equity Loan

Home Equity Loans For Bad Credit 1.

. HEM is your best source with home equity loans for people with bad credit problems. The interest rates are. If your credit is poor enough that you dont qualify for a loan on your own.

5 rows 6. At least 15 equity in your home. Forbes Advisor compiled a list of HELOC lenders that excel in various areas including offering low fees low loan costs convenience and flexibility.

We will connect you to the leading home equity brokers who provide sub-prime loans in your local. If you have a good credit score and qualify for a loan with a 6 interest rate monthly payments will be 111. Best for first-time home buyers.

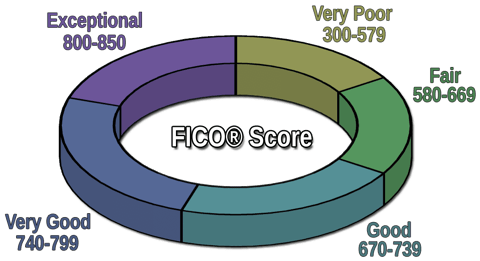

New American Funding. Easy to OwnSM programs give options for those with lower income limited credit history and low down payment needs. Most lenders look for a credit score in at least the good range to approve a home.

Best for low or bad credit scores overall. Guaranteed Home Equity Loans for Bad Credit Minimum Credit Score for Home Equity Loans. A home equity loan is a secured loan where borrowers get money based on the.

The banks loan officer group offers home equity loans and home equity lines of credit based on the value of your home compared to your existing mortgage balance. For example say youre borrowing 10000 for 10 years. For borrowers with bad credit these requirements are even more important to satisfy.

Lenders like having property as. If you have a bad. Generally speaking some universal.

See application terms and details. A credit score of 620. Requirements you may need to get a home equity loan with bad credit include.

Will I Qualify For a Home Equity Loan With Poor Credit. As a rule of thumb a typical amount to borrow is 85 of the value of your home for a home equity line of credit and 80 for a home equity loan after subtracting the amount you owe on your. Best for FHA loans.

Thats because youre using your home to guarantee the loan. Different lenders have different requirements for approving home equity loans. Here are the typical requirements for getting a home equity loan.

Most lenders wont approve a loan if a borrower has less than. Wells Fargo Home Mortgage.

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Personal Business Loans Home Equity Loans After Bankruptcy Choosing A Low Credit Card Debt Relief Instant Approval Credit Cards Debt Relief

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

5 Debt Management Tips Loans For Bad Credit No Credit Loans Bad Credit

Not Able To Qualify For A Traditional Mortgage Loan Our Private Lenders Can Help In 2022 Private Lender Mortgage Loans Lenders

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

If You Want To Pay Off Your Mortgage Early In Five To Seven Years You Can Using A Simple Home Equity Line Of Credit Also C Line Of Credit Home Equity Heloc

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Discover Home Equity Loans Home Improvement Loans Home Equity Loan Home Equity

Pre Approved Car Loans For Bad Credit Helps Bad Credit Car Buyers To Get Behind The Wheel

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Pin On Home Loans